Apply for Financing

"*" indicates required fields

Competitive Rates.

Creative Financing Programs.

- Low rates and competitive structures

- Application only up to $500,000

- 3 & 6 month deferrals

- $0 down w/ terms up to 72 months

- eDocs available

- Pre-funding available

- No pre-payment penalty

Our knowledge and industry experience is vast. So are our banking relationships. This allows FPG to assist in any type of situation — no matter how commonplace or unique. So no matter the need, the machine, the industry or the timeline, we deliver. But it’s the way we deliver that matters most. Customer satisfaction is our top priority. From the early stages of the application process through sales funding, our team and support staff are available every step of the way to aid, assist and answer questions that arise.

90% approval ratio and over $370,000,000 funded.

No one understands the position our clients are in better than we do. For many businesses, the need for the latest commercial equipment is paramount in order to grow their business. For others, this equipment is necessary to maintain their leadership position in their field.

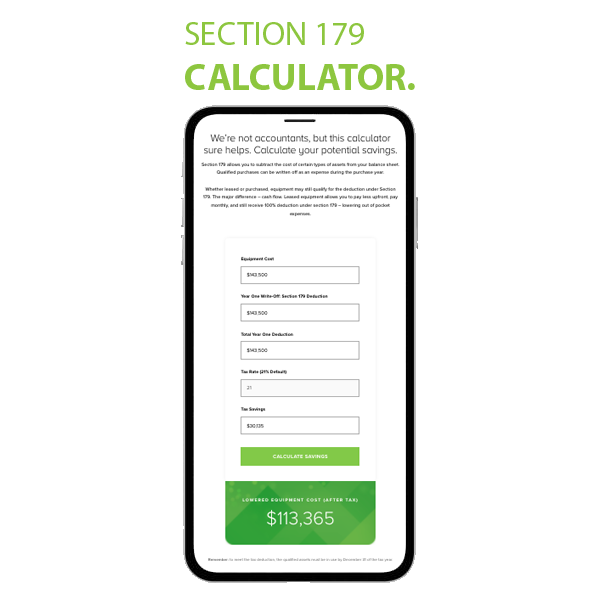

SECTION 179 TAX SAVINGS

Allows you to subtract the cost of certain types of assets from your balance sheet. Qualified purchases can be written off as an expense during the purchase year.

Whether leased or purchased, equipment may still qualify for the deduction under Section 179. The major difference – cash flow. Leased equipment allows you to pay less upfront, pay monthly, and still receive 100% deduction under section 179 – lowering out of pocket expenses.

In seven-minutes:

- Read the guide

- Calculate your potential savings

- Learn how to deduct equipment

This application was completed for commercial purposes and not intended to be used for consumer purchases. I hereby authorize our banks, trade references, and financial institutions the right to release credit information for EyeDirect and/or its assignees. The undersigned individual, recognizing that his or her individual credit history may be a factor in the evaluation of the credit of the applicant, hereby consents to and authorizes the above-named business credit provider and any assignee, lender, or funding service that may be utilized to obtain and use a consumer credit report on the undersigned, now and from time to time, as may be needed in the credit evaluation and review process and waives any right or claim they would otherwise have under Fair Credit Reporting Act in the absence of this continuing consent. The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age (provided the applicant has the capacity to enter into a binding contract), because all or part of the applicant’s income derives from any public assistance program or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act. The federal agency that administers compliance with this law is the Federal Trade Commission Equal Credit Opportunity, Washington, D.C. 20580. If your application for business credit is denied, you have the right to a written statement of the specific reasons for the denial. To obtain the statement, please contact Lessor set forth.